Reloadable Debit Cards

What are reloadable debit cards?

Reloadable debit cards work like traditional debit cards. Customers can load funds and use to shop, transfer money, pay bills, withdraw cash from an ATM and receive direct deposits of payroll and government benefits. They can be used anywhere Visa, MasterCard or American Express cards are accepted

How to set up your

reloadable debit card

Select your card

Browse through the various reloadable debit cards available at Walgreens and decide which card is right for you.

Purchase and register your card

Visit any of our >8,000+ locations to purchase and load your card. Funds on temporary cards can be used for purchases. All cards come with instructions to register. To register your card, you will need to provide your name, address, date of birth and Social Security number. Once registered and your information is successfully veried, you will typically receive a personalized card in the mail approximately 7–10 business days.

Reload your card

Add funds to your card with direct deposit or with cash in store at any of our convenient locations.†Footnote

Use your card

Use your reloadable debit card to shop, get cash at ATMs, pay bills online or shop in stores anywhere Visa, MasterCard or American Express cards are accepted.

† Some cards require a Reload Card for adding funds. Walgreens engages in the money transmission and/or currency exchange business as an authorized delegate of GPR Card MSB's under chapter 151 of the Texas Finance Code. If you have a complaint, rst contact the consumer assistance division of Walgreens Co. at 877-865-9130, if you still have an unresolved complaint regarding the company's money transmission or currency exchange activity, please direct your complaint to: Texas Department of Banking, 2601 North Lamar Boulevard, Austin, Texas 78705, 1-877-276-5554 (toll free), www.dob.texas.govopens in new tab

Find these cards

at your local Walgreens

Find store

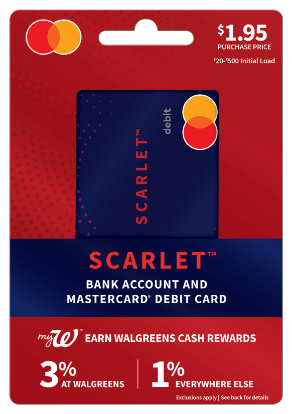

ScarletTM Bank Account and

Mastercard® Debit Card

Start earning

Walgreens Cash rewards when you use your Scarlet debit card for purchases3Footnote

- 5% on Walgreens branded products

- 3% on all other Walgreens purchases

- 1% everywhere else Mastercard is accepted

Registration is required. Fees and limits apply. Learn moreopens in new tab

1 Free in-network ATM withdrawals at over 55,000 Allpoint ATMs.

2 Terms and conditions apply. You can add cash at other locations for up to $3.95. For details, please visit getScarlet.com/Legal. Message and data rates may apply.

3 Must be a myWalgreens™ member. Walgreens Cash rewards are not legal tender. No cash back. Walgreens Cash rewards good on future purchases. Exclusions apply. Complete details, including Walgreens Cash rewards expiration dates and Demand Deposit Account Rewards Terms, at getScarlet.com/Legalopens in new tab. Scarlet™ Bank Account is a demand deposit account established by Pathward, National Association fka MetaBank, Member FDIC. Scarlet account terms, conditions and fees apply. Please see Deposit Account Agreement for complete details. Card is issued by Pathward pursuant to license by Mastercard® International Incorporated and the circles design is a registered trademark of Mastercard International Incorporated.

Green Dot Visa® Debit Cards

Your banking. Your choice. Green Dot has an account for you.

Green Dot Visa® Debit cards have smart everyday banking features to help you better access, budget and manage your money—anytime, anywhere you need it.

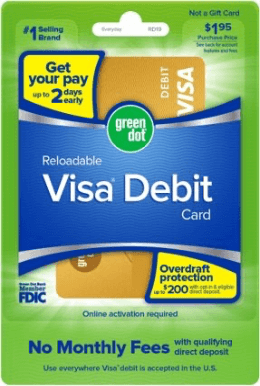

- Green Dot EveryDay Visa® Debit Card

- No monthly fees with qualifying direct deposit

- Get your pay up to 2 days early

- Overdraft protection up to $200 with opt-in & eligible direct deposit

Personalized card required. Fees and limits apply. Learn moreopens in new tab

See account agreement for terms and conditions. When you direct deposit $500 or more in the previous monthly period, otherwise $7.95 per month. Direct deposit early availability depends on timing of payor's payment instructions and fraud prevention restrictions may apply. As such, the availability or timing of early direct deposit may vary from pay period to pay period. $15 fee may apply for each purchase transaction not repaid withing 24 hours of authorization of first transaction that overdraws account. Overdrafts paid at our discretion.

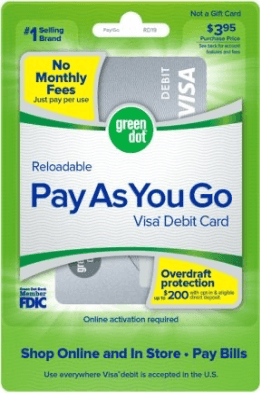

- Green Dot Pay As You Go Visa® Debit Card

- No monthly fees, just pay per transaction.

- Shop online and in stores, plus pay bills

- Overdraft protection up to $200 with opt-in & eligible direct deposit

Personalized card required. Fees and limits apply. Learn moreopens in new tab

See account agreement for terms and conditions. $15 fee may apply for each purchase transaction not repaid withing 24 hours of authorization of first transaction that overdraws account. Overdrafts paid at our discretion.

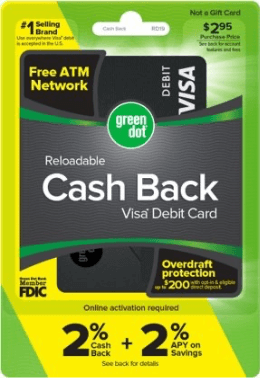

- Green Dot Cash Back Visa® Debit Card

- 2% Cash Back online and mobile purchases

- 2% APY on savings up to $10,000 balance

- Overdraft protection up to $200 with opt-in & eligible direct deposit

- Free cash reloads using the app

Personalized card required. Fees and limits apply. Learn moreopens in new tab

See account agreement for terms and conditions. Cash back cannot be used for purchases or cash withdrawals until redeemed. Claim cash back every 12 months of use and your account being in good standing. 2.00% Annual Percentage Yields (APYs) are accurate as of 3/8/21 and may change before or after you open an account. $15 fee may apply for each purchase transaction not repaid withing 24 hours of authorization of first transaction that overdraws account. Overdrafts paid at our discretion.

- Two Ways to Reload Cash to Your Green Dot Card

Reload at the RegisterSwipe your card at the register to immediately reload with cash. Learn moreopens in new tab

Reload at the RegisterSwipe your card at the register to immediately reload with cash. Learn moreopens in new tabReload fees and limits apply.

MoneyPak

MoneyPakSend cash quickly and conveniently to almost anyone. Learn moreopens in new tab

Service fee and limits apply. Must be 18 or older to use this product. Card must be activated and personalized with cardholder's name. Check card eligibility and other requirements at MoneyPak.comopens in new tab

GO2bank Visa® Debit Card

- No monthly fees with qualifying direct deposit

- Get your pay up to 2 days early

- Overdraft protection up to $200 with opt-in & eligible direct deposit

- Free ATM Network—withdraw cash at thousands of free in-network ATMs nationwide

Personalized card required. Fees and limits apply. Learn moreopens in new tab

See account agreement for terms and conditions.

Direct deposit early availability depends on timing of payor's payment instructions and fraud prevention restrictions may apply. As such, the availability or timing of early direct deposit may vary from pay period to pay period. $15 fee may apply for each purchase transaction not repaid within 24 hours of authorization of first transaction that overdraws account. Overdrafts paid at our discretion. $3 for out-of-network withdrawals. ATM owner may also charge a fee. ATM limits apply.

Serve®

Serve is made with you in mind, with flexible options to fit your life. With a suite of options to choose from, Serve allows you to handle your money with ease. Our cards give you the freedom to spend online or in stores, the protection to safeguard your money, and the convenience of easy access:

- No credit check

- Easy registration

- Money management on the go

- Serve® Reloadable Visa® Debit Card & Bank Account - Serve Cash Back

Get rewarded with unlimited 1% Cash Back when you shop in stores or online, everywhere Visa® debit cards are accepted. Redeem the cash back in your account and it will be applied to future purchases.1bFootnote

1b With the Serve Cash Back card, earn 1% Cash Back on purchases (less returns/credits) rounded to the nearest dollar, added to your account after you use your card. Rounding purchases to the nearest dollar means that you won’t earn a fraction of a penny in Cash Back. For example, a purchase of $0.01-$0.49 rounds to $0.00 (you don’t earn Cash Back), a purchase of 0.50-$0.99 rounds to $1.00 (you earn $0.01 Cash Back), and so on. Account spend limits apply. Cash Back is typically applied to your account promptly after purchase but could take up to 60 days. Cash Back can be redeemed and used only for future purchases made with your card and cannot be redeemed for cash or otherwise exchanged for value. ATM transactions, fees, and Serve online bill pay are not purchases and do not earn Cash Back. For full terms and restrictions, see the Cash Back Demand Deposit Agreement.

Serve® Bank Account is a demand deposit account established by Pathward®, National Association, Member FDIC. Funds are FDIC insured, subject to applicable limitations and restrictions when we receive the funds deposited to your account. Account terms, conditions, and fees apply. Please see the Deposit Account Agreement for complete details. Card is issued by Pathward® pursuant to a license by Visa® U.S.A., Inc. Card can be used everywhere Visa debit cards are accepted.

Copyright © 2024 InComm Payments™. All Rights Reserved. All trademarks are the property of their respective owners.

- Serve® Reloadable Visa® Debit Card & Bank Account – Serve Free Reloads

Whether you're looking to budget, pay bills online or manage day-to-day expenses, free reloads means you can add cash often without incurring fees at thousands of participating retailers.2bFootnote

2b Add cash for free at participating retailers nationwide: 7-Eleven (select locations), CVS, Dollar General, Family Dollar, Rite Aid, and Walmart. Barcode reloads on your mobile app at Walgreens locations are free and swipe reloads at Walgreens locations incur a fee of up to $3.95. Reloads outside of these retailers can incur a fee of up to $3.95.

Serve® Bank Account is a demand deposit account established by Pathward®, National Association, Member FDIC. Funds are FDIC insured, subject to applicable limitations and restrictions when we receive the funds deposited to your account. Account terms, conditions, and fees apply. Please see the Deposit Account Agreement for complete details. Card is issued by Pathward® pursuant to a license by Visa® U.S.A., Inc. Card can be used everywhere Visa debit cards are accepted.

Copyright © 2024 InComm Payments™. All Rights Reserved. All trademarks are the property of their respective owners.

- Serve® Pay As You Go Visa® Prepaid Debit Card

This account gives you the freedom to spend when and where you want, on your own terms. With no hidden or monthly charges, you only pay a small fee when you make a purchase.3bFootnote Know what you pay, and pay as you go.

3b Serve Account terms, conditions and fees apply. Please see Cardholder Agreement for complete details.

Serve® Pay As You Go Visa® Prepaid Card is issued by Pathward®, National Association, Member FDIC. Funds are FDIC insured, subject to applicable limitations and restrictions when we receive the funds deposited to your account. Account terms, conditions, and fees apply. Please see the Cardholder Agreement for complete details. Card is issued by Pathward® pursuant to a license by Visa® U.S.A., Inc. Card can be used everywhere Visa debit cards are accepted.

Copyright © 2024 InComm Payments™. All Rights Reserved. All trademarks are the property of their respective owners.

Netspend® Visa® Prepaid Card

- Get paid up to 2 days faster with direct deposit2cFootnote

- No minimum balance requirement

- Manage your money anywhere with our mobile app3cFootnote

1c ID verification required. We will ask for your name, address, date of birth, and your government ID number. We may also ask to see your driver's license or other identifying information. Card use restrictions may apply. See netspend.com or card order page for details. Residents of Vermont are ineligible to open a card account.

2c Faster funding claim is based on a comparison of our policy of making funds available upon receipt of payment instruction versus the typical banking practice of posting funds at settlement. Fraud prevention restrictions may delay availability of funds with or without notice. Early availability of funds requires payor’s support of direct deposit and is subject to the timing of payor’s payment instruction.

3c Netspend does not charge for this service, but your wireless carrier may charge for messages or data. The Netspend Visa Prepaid Card is issued by Pathward, National Association, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Netspend is a registered agent of Pathward, N.A. Card may be used everywhere Visa debit cards are accepted. Certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787. Use of the Card Account is subject to activation, ID verification, and funds availability. Transaction fees, terms, and conditions apply to the use and reloading of the Card Account. See the Cardholder Agreement for details.

© 2022 Netspend Corporation. All rights reserved worldwide. All other trademarks and service marks belong to their owners.